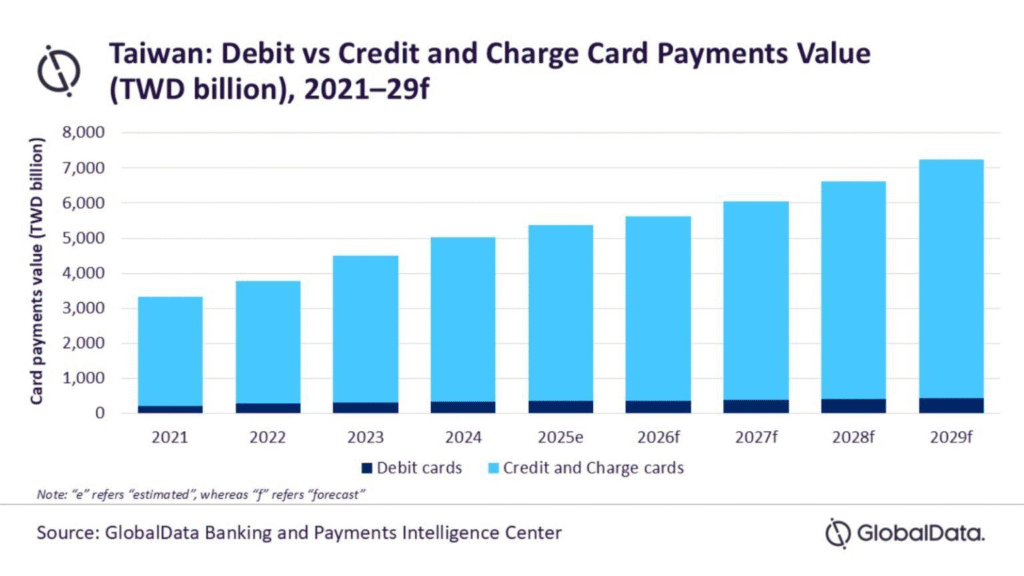

Taiwan is rapidly advancing toward a cash-light future, a shift that is expected to make the island more attractive and convenient for international visitors. According to new research from GlobalData, card payments in Taiwan are projected to grow at a compound annual growth rate (CAGR) of 7.7% between 2025 and 2029, reaching TWD7.2 trillion (US$225.3 billion).

For travelers, the move to cashless payments is more than a financial trend—it directly impacts the ease of exploring a destination. With 95.8% of adults in Taiwan expected to be banked by 2025, tourists benefit from a card-friendly environment that reduces the need for physical currency exchanges, often one of the first hurdles for international arrivals.

Credit Cards Dominate the Market

While debit card ownership is high—averaging more than five cards per person—their role in spending remains limited, accounting for only 6.7% of transaction value in 2025. Instead, credit cards dominate, representing 93.3% of all card payments. This dominance translates into real-world convenience for tourists, from booking hotels and flights online to paying for dining, tours, and transportation on the ground. Many merchants also offer card payment discounts, cashback, and loyalty rewards, further incentivizing usage.

E-commerce and Pre-Travel Spending

The rise of e-commerce has also strengthened the link between digital finance and tourism. In 2024, credit cards accounted for 33% of all e-commerce transaction value, underpinning purchases such as flights, accommodation, and attraction tickets. This integration means a seamless pre-travel experience for international visitors where planning and payment can be completed long before setting foot in Taiwan.

Policy Push Toward a Cash-Light Economy

Government policy is playing a central role in accelerating this transition. Taiwan’s Central Bank and the Financial Supervisory Commission (FSC) have set a target of eight billion non-cash transactions by 2026. This modernization benefits local consumers and streamlines the visitor journey, removing barriers related to foreign exchange and cash handling.

Analyst Insight

“While debit card penetration is high in Taiwan, credit cards dominate the market thanks to incentives like cashback, rewards, and installment plans,” said Sidharth Das, Banking and Payments Analyst at GlobalData. “This trend is reinforced by the growth of e-commerce and the widespread acceptance of credit cards for online purchases.”

Outlook: Taiwan Joins Asia’s Cashless Leaders

Taiwan’s shift mirrors the cashless readiness of markets like South Korea and Singapore, both recognized for their digital-first payment ecosystems. By 2029, when card payments are forecast to reach US$225.3 billion, Taiwan is expected to stand among Asia’s most visitor-friendly destinations, offering seamless transactions and fewer barriers for international travelers.