Apps reshape cross-border payments as consumers demand security, speed, and convenience

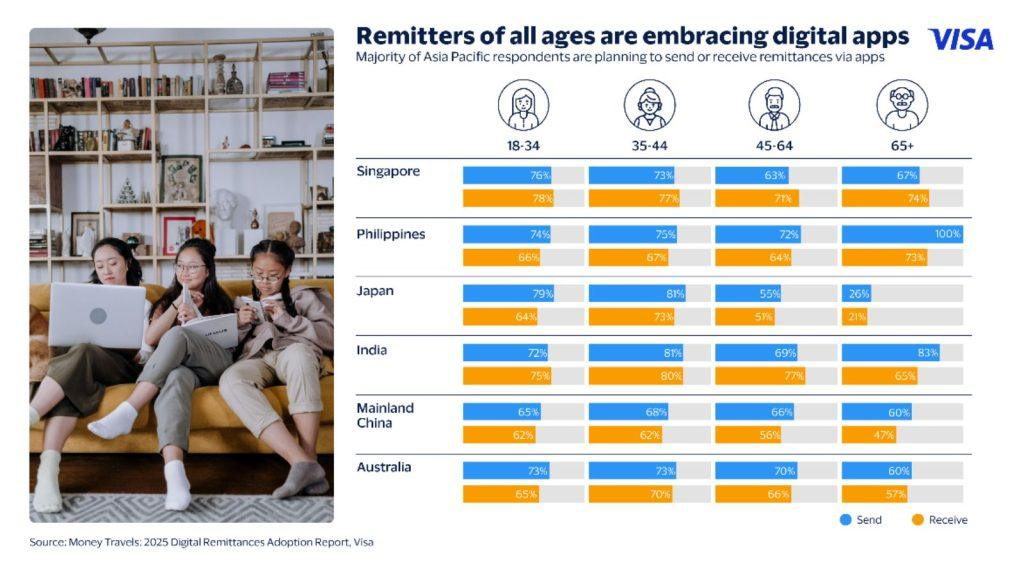

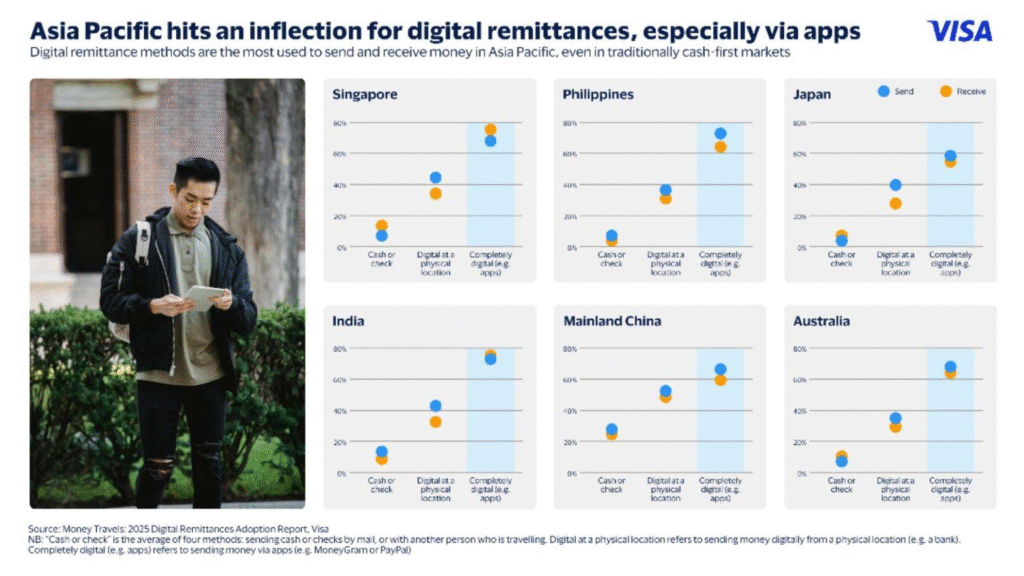

Asia Pacific is witnessing a decisive shift toward digital money transfers, with mobile applications emerging as the dominant channel for sending and receiving remittances, according to Visa’s Money Travels: 2025 Digital Remittances Adoption Report. The comprehensive study, based on responses from 44,000 consumers across 20 countries and territories, places the region at the forefront of global remittance transformation within a $905 billion industry.

A Digital-first Landscape

The findings highlight that consumers across the Asia Pacific increasingly value the security, speed, and ease of app-based transactions over traditional channels such as banks, agents, and cash-based remittances. Adoption is highest in India (74% sending, 76% receiving), the Philippines (74%/66%), and Singapore (70%/75%), while Japan is showing notable momentum with a 10% year-on-year increase, now reaching 58% of senders and 56% of receivers.

“Remittances have long driven growth across Asia Pacific, uplifting economies and households alike,” said Chavi Jafa, Senior Vice President, Head of Commercial and Money Movement Solutions, Asia Pacific, Visa. “The clear migration to app-based remittances reflects both the region’s demographics and its embrace of digital payments. Consumers are seeking faster, safer, and more reliable methods of sending and receiving money—and this trend will shape how banks, remitters, and fintechs engage with them in the future.”

Key Insights From the 2025 Report

1. Apps as the fastest and most trusted channel

- More than half of remittance users in India, the Philippines, Singapore, and Australia cited digital apps as the fastest way to access funds.

- Security remains a top driver, with India (50% of senders, 53% of receivers), Australia (49%/45%), and Singapore (44%/42%) leading in confidence levels.

2. Ease of use as a differentiator

- Singapore (51% of senders/receivers), the Philippines (48%/54%), and Japan (47%/42%) ranked ease of use among the top reasons for choosing digital transfers.

3. Costs remain a hurdle

- Despite strong adoption, high fees are consistently identified as the leading pain point. In the Philippines, 43% of senders and 30% of receivers flagged app-based fees as burdensome, followed by India (36%/33%) and Singapore (32%/32%).

4. Traditional remittances losing ground

- Long travel distances and the inconvenience of physical outlets continue to deter users in India (36%) and Mainland China (27%).

- Security perceptions are weak across most Asia Pacific markets, with confidence in physical remittances rated as low as 3%–6%, underscoring a declining preference for cash-based channels.

Diverse Motivations Across Markets

The report also highlights the varied purposes behind remittances in the Asia Pacific:

- Investments and savings: A key driver in Mainland China (45% of senders, 36% of receivers), Singapore (38%/33%), and Japan (27%/23%).

- Humanitarian support: Strong in Mainland China (45%/33%), India (40%), Singapore (27%), and Australia (25%).

- Unexpected needs: Particularly significant in India (44%), the Philippines (41%), and Australia (31%).

- Regular support: Around one-third of respondents in the Philippines (39%), Mainland China (34%), and India (30%) receive remittances on a recurring basis.

The Broader Economic Impact

Remittances play an outsized role in Asia Pacific economies, not only sustaining families but also supporting small enterprises and local development. This lifeline effect is especially critical in emerging markets where migrant worker income represents a major contribution to national GDP.

“Remittances will continue to be a lifeline across Asia Pacific, uplifting households and supporting small businesses that form the backbone of local economies,” said Rhidoi Krishnakumar, Vice President, Head of Visa Direct, Asia Pacific. “At Visa, we see our role as enabling faster, more reliable, and more secure money movement that expands financial access and strengthens community resilience.”

Strategic Partnerships for the Future

Visa continues to collaborate with global remittance providers, including MOIN, WireBarley, Money Chain World Remittance, and EzRemit. These partnerships are designed to enhance digital infrastructure, streamline cross-border payments, and reduce operational friction for consumers and businesses alike.

With one billion people worldwide relying on remittances each year, the industry’s pivot toward digital channels marks not only a technological evolution but also a shift in consumer trust and expectations. For Asia Pacific—home to some of the largest remittance corridors in the world—the momentum toward apps is expected to accelerate, reshaping how money moves across borders in the decade ahead.